Latvian pension system consists of three pillars. In the first two pillars, the money is being automatically deducted from your taxable income, while in the third pillar it is your free choice to make contributions to it on your own. Each of these three pillars is essential for your pension accruals.

1st pension pillar: state mandatory unfunded pension scheme, monthly contributions to which make 14% of your income taxable with the social security contributions to. This money is being accounted virtually, meaning that your contributions are being registered, but this money is actually being used to pay pensions to today’s pension receivers. So, by making contributions to this pension pillar, you are both building your pension capital and taking care of today’s elderly people.

2nd pension pillar: state funded pension scheme, monthly contributions to which, according to the effective legislation, make 6% every month from your income taxable with the social security contributions. Everyone born after 1 July 1971 are obligated to join this pillar, while others can join voluntarily. Unlike the first pillar, in the second pension pillar you accumulate real money, which you can entrust to the asset manager of your choice by joining one of the pension plans offered by this manager.

The task of the manager is to invest your money in stock, securities and other financial instruments in order to grow your pension capital, which means increasing the amount of your old age pension.

Currently there are seven managers of 2nd pension pillar assets registered in the register of the state funded pension scheme. Each of them offers one or more investment plans, making the total number of options exceed 29. Learn more about how to not get lost in the offer and how to choose the plan that suits you best in article "How to compare the second pillar pension plans wisely?”

3rd pension pillar: private voluntary pension scheme to which you can every month pay an amount of your choice every month to create your pension capital. You can sign an agreement with your employer to make the regular contributions to your third pension plan for you.

It is estimated that the first and second pillar pension combined will only make the amount of pension for you that is less than 60% of your pre-retirement income. While in order to keep your usual quality of life, your pension should amount to at least 70% of your pre-retirement income. You can make that happen by starting to invest in 3rd pension pillar now, making contributions to a 3rd pension pillar plan of an asset manager of your choice or make regular investments in other well-diversified financial instruments, for example, mutual funds or index funds. Just like it happens in the 2nd pillar pension plans, the manager will invest your money in stock, debt securities and other financial instruments in order to make your pension capital grow.

Another advantage of the 3rd pension pillar is that you can get 20% income tax return from the contributions you made, as well as apply for receiving this pension capital before your retirement – already when you reach the age of 55. Moreover, both 2nd and 3rd pension pillar savings are inheritance, which means you can appoint a heir to this capital in case you do not reach the retirement age.

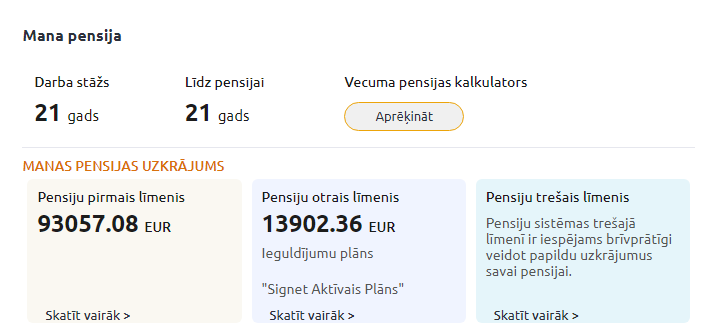

How to find out the amount of savings in your first and second pension pillar?

To obtain your calculations, go to the Latvija.lv website and select the section "Information and services of the State Social Insurance Agency". On the opened page, check the box agreeing to the terms of use and click the "Request Service" button. Confirm that you agree to the conditions of identification and undergo authentication in a way convenient for you. Next, you will see a statement reflecting your savings in all three pension levels, as well as your accumulated years of work experience and the remaining years until retirement.

The data about the pension accruals in both pillars you can also obtain at any office of the State Social Insurance Agency.

Where can I find out my 3rd pension pillar savings?

Given that the 3rd pension pillar scheme is voluntary, you can find out the amount of your savings also from your asset manager – in their online banking platform or similar portal. There you will see also the performance of the pension plan and fluctuations in their return.

In order to ensure yourself a warm existence in your old age, it is important to use the benefits of all three pension pillars available in Latvia and participate in all of them. Because the longer you will be working and paying social security contributions, and the more thought you will give to choosing your 2nd and 3rd pension pillar plans, the bigger pension you will receive in old age.