Latvian pension system consists of three levels (pillars). Into the first two pillars the money is being transferred automatically the moment your social insurance contributions are deducted from your taxable income, while participation in the third pension pillar is voluntary and you can make contributions on your own. And each of these pillars are of significant role in your pension accruals.

1st pension pillar: state mandatory unfunded pension scheme, monthly contributions to which make 14 % of the income from which social contributions are made. In the first pillar, the pension accruals are virtual, meaning that your contributions are registered, yet actually this money is being disbursed to today’s pension receivers. Thus in your first pension pillar you are making your own accruals, at the same time taking care of today’s pensioners.

2nd pension pillar: state funded pension scheme, monthly contributions to which, according to the effective legislation, make 6% of the income from which social contributions are made. Everyone born after 1 July 1971 are obligated to join this pension pillar, while others can join voluntarily. Unlike the first pension pillar, in this second pillar the accrued money is real, not virtual, and you can freely choose a manager for it by joining any of this manager’s pension plans.

The task of the manager is to invest your money in stock, securities and other financial instruments in order to grow your pension capital, which means increasing the amount of your old age pension.

3rd pension pillar: private voluntary pension scheme to which you can every month pay an amount of your choice every month to create your pension capital. You can sign an agreement with your employer to make the regular contributions to your third pension plan for you.

It is believed that the first and second pension pillars together will ensure approximately 50-60% of your income amounts you will be receiving shortly before retirement. However, in order to maintain the previous quality of life, pension amounts should constitute at least 70% of the pre-retirement income. It can be achieved by starting contributions to 3rd pension pillar as early as possible and investing this money into a pension plan of the manager of your choice or regularly invest in other well-diversified financial instruments like investments funds or index funds. Similarly like in 2nd pension pillar manager will invest your money into stock, securities and other financial instruments with the aim to grow your pension accruals.

Significant advantage of 3rd pension pillar is that you can claim 20% income tax reimbursement from the contributions of up to 4000 euros a year, as well as receive the accrued capital before reaching the retirement age – when you reach 55 years of age. Moreover, 1st and 2nd pension pillars are subject to inheritance, which means you can appoint a heir to this capital in case you do not reach the retirement age.

If you are economically active person, making contributions to at least the first two pension pillars, the pension calculator can help you calculate what your pension could be upon retirement.

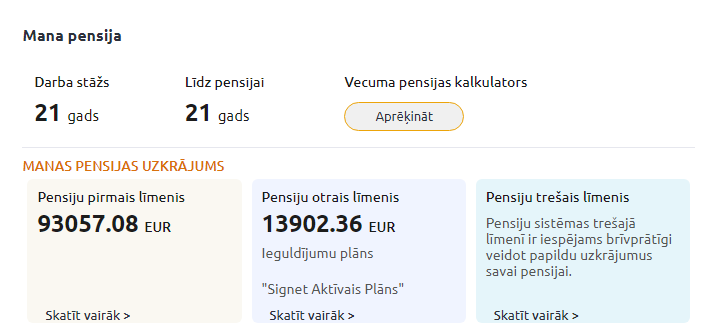

To obtain your calculations, go to the Latvija.lv website and select the section "Information and services of the State Social Insurance Agency". On the opened page, check the box agreeing to the terms of use and click the "Request Service" button. Confirm that you agree to the conditions of identification and undergo authentication in a way convenient for you. Next, you will see a statement reflecting your savings in all three pension levels, as well as your accumulated years of work experience and the remaining years until retirement.

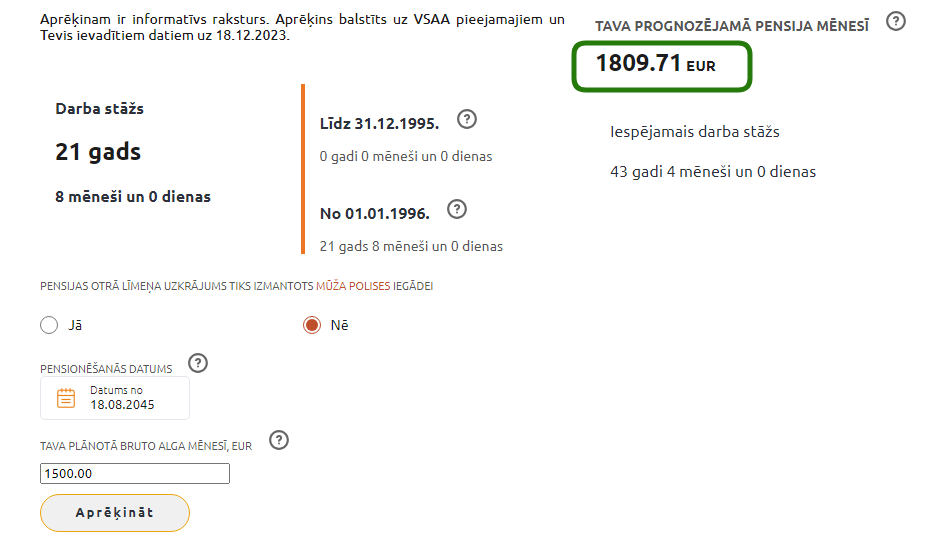

To access the retirement pension calculator, click the "Calculate" button. Here, indicate whether your second pillar pension savings will be used to purchase a lifelong policy, and specify your planned gross monthly salary, for example, 1500 euros. Click the "Calculate" button once more, and you will see the projected pension amount, which in this case is 1809.71 euros.

However, when using this calculator, keep in mind that it only gives approximate view of the amount of your pension, since it is based on assumptions like your potential gross salary and the performance of the chosen pension plan, which in reality may differ from those used in the calculations.

In any case, the larger your pre-retirement income and social contributions, the higher your pension will be. Therefore, it's important to take care of your savings in a timely manner.